MODULE THREE

How to forecast your cash flow.

Not familiar with spreadsheets? Here's a short video to walk you through how to edit, update and save your cash flow forecast.

Cash flow forecasting is all about estimating the future income and future expenditure of your business. While it’s typically prepared at the beginning of a financial year, a cash flow forecast can be created at any time. It’s all about timing, so try to be as accurate as possible when estimating future inflows and outflows of cash.

Follow these simple steps and let’s get started.

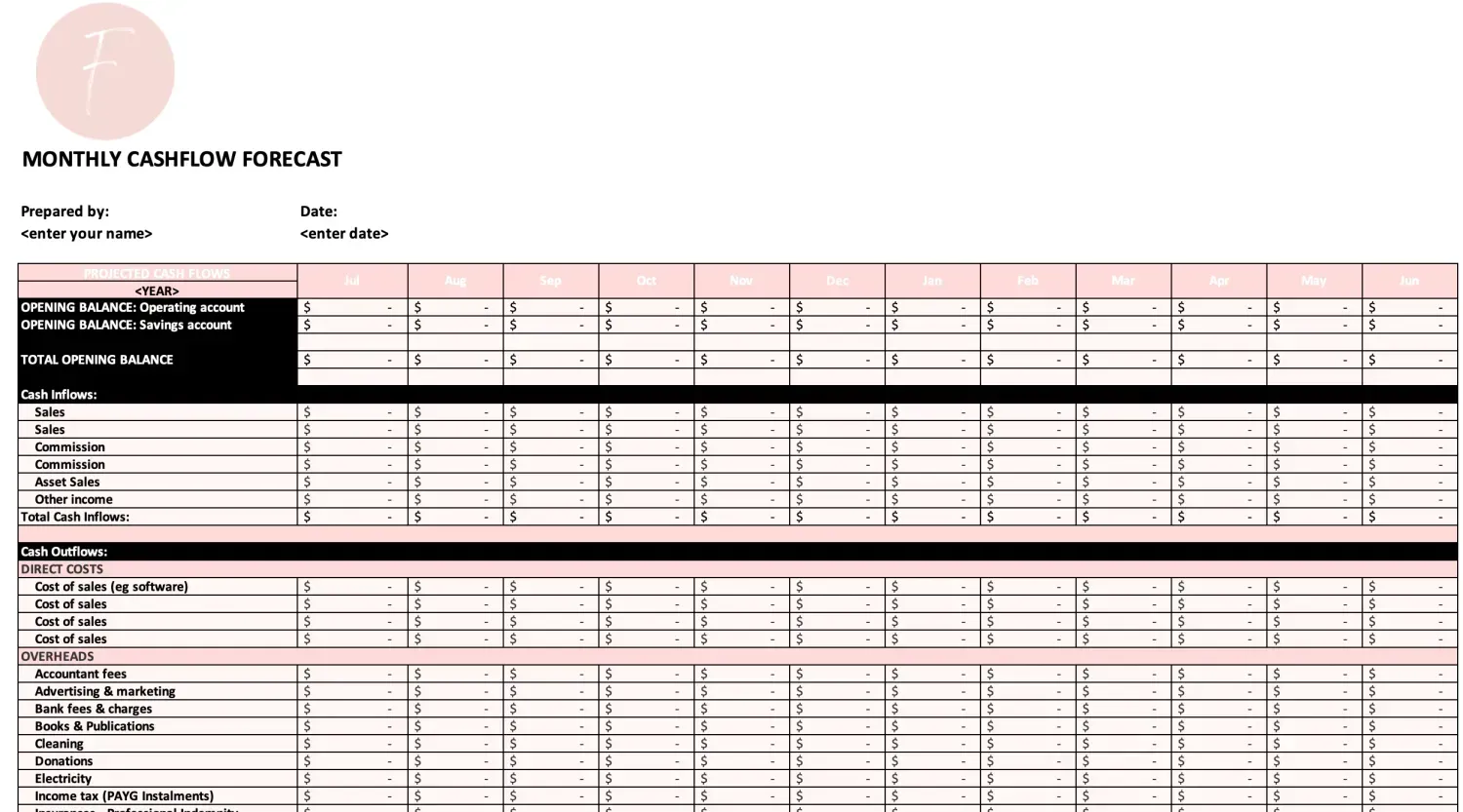

Start by downloading the cash flow forecast template here.

Step One: Tailor the cash flow forecast spreadsheet to suit your business.

Once you’ve downloaded the cash flow forecast template included with this module, review the template and tailor it so it’s specific for your business. You'll want to add revenue, direct cost and operating expense buckets that are specific to your business.

This cash flow forecast has been created as a deliberately simple document to help you avoid overwhelm, especially if you don’t like spreadsheets. If you’re unsure about using a spreadsheet, watch the video for clarity.

Step Two: Forecast your future sales or revenue.

It’s a good idea to create a cash flow forecast for a full year of incoming revenue and outgoing expenses. However, if this seems like a daunting task, perhaps start with a 90 day forecast instead.

While you can create a daily or weekly forecast, I recommend a monthly forecast as best practice.

For a lot of business owners, forecasting future sales will land in the too hard basket. It’s like looking into a crystal ball and having a best guess which may seem like mission impossible. For that reason, I recommend a look back over your sales figures from last financial year. These will not only provide a jumping off point in estimating projected sales targets over the year ahead but can also highlight the peaks and troughs for sales and where you might need to make adjustments.

Now, it’s not going to be a perfect science, but in my experience, it’s the best way to look forward. Of course, if you know you have a major launch or a new product offering in a certain month, you can adjust your revenue projections accordingly. Likewise, if you intend to increase prices includes your projections based on the price increase.

Also keep in mind when you expect to receive payments. This will apply more to service-based business owners, because It’s one thing to include likely sales but if your clients are slow payers, you may want to take account of the income when you think you’ll receive it rather than the date you invoice.

Step Three: Consider any other business cash inflows.

Most businesses will receive the bulk of their cash inflow from sales, however, there may be other non-sales income that you know will be coming into your business in the year ahead. So, when preparing your cash flow forecast also consider the following:

Are you likely to receive any tax refunds?

Have you applied for a business grants that should be considered?

Do you have capital coming into the business from investors?

Will you receive any royalties or licence fees?

Step Four: Estimate the cost of doing business – what are your expenses and outgoings?

Now this is the relatively easy part because in most cases business expenses are due at the same time every week, month or the same time every year. So, look back over the expenses you paid out last year or review your bank account and determine what expenses are due to be paid and when. Add these expenses into the spreadsheet in the month they fall due.

You may want to consider adding a small increase to existing expenses for inflation too. If you’re including ‘cost of sales’ (COGS) items in the expenses, you may want to add in a per unit cost based on your sales projections rather than a total amount.

For example: If you know that the COGS for a particular service is $100 and you estimated you would sell ten of these services in July, then include a simple calculation formula into that cell. It looks like this: =10*100 Adding a formula in this way means that as you update your spreadsheet for actuals or if you decide to recalculate your estimates it’s as simple as adjusting the formula. So, let’s say I revised my projection to sell 5 items the new formula would look like this =5*100 or if the unit price for the COGS increased to say $120, I could adjust the formula like this =10*120

In addition to the usual business expenses, you will also want to include a line for expenses such as:

Rent

Salaries and contractor fees

Superannuation payments for staff and for yourself

Loan repayments

Tax bills

Dividends

New planned asset purchases

Upgrades to tech or business systems

Step Five: Add your opening bank balances.

As cash flows are based largely on the money moving through your main operating account, you need to add the bank balance on the day the cash flow forecast starts as the opening balance in the spreadsheet. For example: If you intend to start forecasting from 1 July, then the opening balance should reflect the bank balance on 1 July.

If you have multiple business accounts, for example an operating and a savings account, it’s worthwhile adding the opening balance for each account on a separate line.

Once the opening balances and the projected revenue and expenses are in place, the cash flow forecast is ready to go. Now it’s about reviewing the project net balance of the business each month to determine your cash flow position.